Like materials pricing, labour shortages can significantly impact the cost of construction projects. This puts countless UK properties at risk of underinsurance, often without the knowledge of owners, managers, and key stakeholders.

In this article, we explain the link between labour shortages, construction costs, and your coverage – and detail how you can safeguard your business against underinsurance.

Materials Costs Aren’t the Most Pressing Concern for Underinsurance in 2025

Materials costs are often the first (and perhaps the only) factor that comes to mind when most think about the changing price of construction.

Whether due to scarcity or high demand, the cost of timber, bricks, or other materials can increase substantially, and, as the sum of these parts, a building of course costs more to complete.

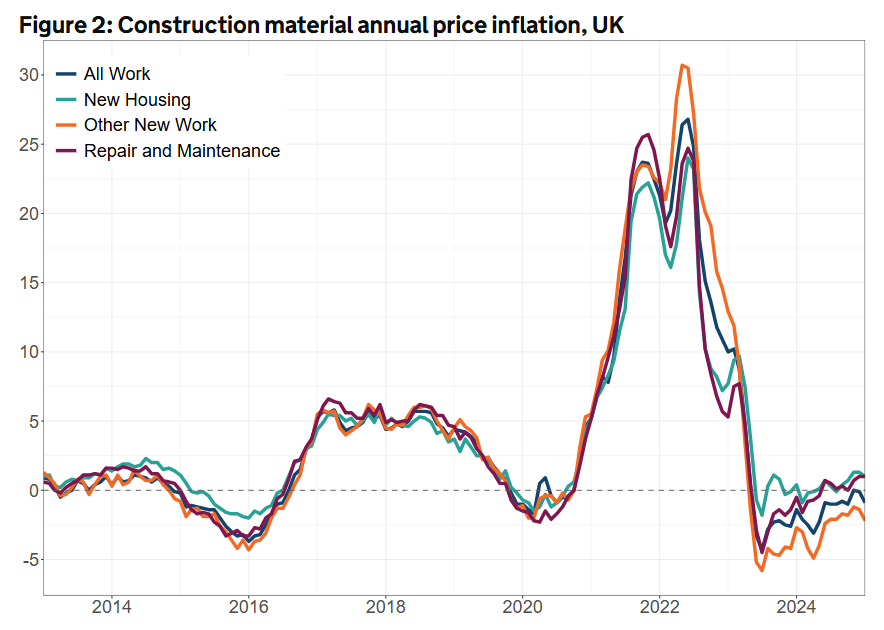

However, while a focus on materials costs is important, especially as the UK saw such an unprecedented spike following the COVID-19 pandemic, prices are now stabilising. And while it’s true that ripples from the impact of US tariffs may eventually have an indirect effect on supply chains, it’s suspected that this cooling will continue.

Source: Construction building materials: commentary June 2025

It’s not that materials costs won’t rise. In fact, according to the BCIS building forecast, materials inflation is projected to grow at a normal rate over the next 5 years (roughly 13%), having been on decline between Q3 of 2023 to Q2 of 2024.

Yet, despite that recent period of deflation, the BCIS All-in Tender Price Index suggests the cost to client during initial commitment to build is on the rise — with labour at the crux of the issue.

When it comes to insurance, the concern is that the well-publicised stability of materials costs will give property owners a false sense of security that renewed valuations are not necessary.

The Labour Shortage and the Cost of UK Construction in 2025

What Caused the UK’s Construction Labour Shortage?

According to reports referenced by The Global Recruiter, the current labour shortage in construction in the UK is the most severe in decades. It’s the result of several contributing factors — chief among them being Brexit.

The end of free movement between the UK and EU significantly reduced the pool of available skilled and semi-skilled workers, many of whom had previously filled key roles in construction trades.

Compounding this, the COVID-19 pandemic led to prolonged project delays, workforce exits, and a backlog of training and certification, particularly among apprentices and new entrants. Many experienced workers chose to retire or change sectors altogether during this period, further depleting the labour force.

In addition, the ageing construction workforce has not been sufficiently replaced by younger generations. Recruitment challenges, perceptions of the industry as physically demanding or unstable, and a lack of long-term government investment in vocational training have all contributed to a talent pipeline that isn’t keeping up with demand.

How Do Labour Shortages Drive Up Construction Project Costs

While materials prices are easy to track and quantify, the cost impact of a labour shortage is often less visible — but just as significant.

In 2025, with fewer skilled workers available, contractors and construction firms are competing for limited labour, leading to increased wages and incentives to attract and retain staff. These higher labour costs are passed directly onto clients through elevated project quotes.

But it’s not just about pay. Short-staffed teams take longer to complete jobs, causing delays that add to overall project timelines — which in turn drives up costs for equipment hire, site management, and insurance. In some cases, projects must pause entirely until the necessary skills become available, creating further financial strain.

The shortage also forces firms to rely more heavily on subcontractors or temporary workers, who often come at a premium and may be less efficient or require additional oversight.

All of this means that, even if materials prices are falling or static, labour constraints are now a primary driver of construction cost inflation.

What Do Rising Construction Costs Mean for Your Property Insurance

If your last reinstatement cost assessment was based on older labour market conditions, there’s a high chance it no longer reflects the true cost to rebuild your business property.

Even modest shifts in labour availability can significantly increase construction costs — and if your coverage hasn’t kept pace, you may be underinsured without realising it. That puts your business at risk of shouldering unexpected costs in the event of damage or disaster.

Cardinus can ensure complete protection. Book a Reinstatement Cost Assessment today.

Tech and Innovation are Helping to Control Costs in Some Cases

The construction industry’s labour deficit is giving companies no choice but to innovate.

Technology such as Building Information Modelling (BIM) is becoming more commonplace, offering digital simulations of a project, helping teams spot potential issues ahead of time, and reducing resource-intensive pivots, mid-job.

Furthermore, off-site modular construction is helping to streamline project timelines. This is where components are prepared in a factory and delivered to the site, ready to be assembled.

But these approaches have their limitations. BIM can reduce hold-ups, but it can’t put boots on the ground, and the modular rebuild approach may not be possible depending on the nature of your property and its location.

Why Labour Costs Have a Bigger Impact on Reinstatement Costs than Materials?

While materials are a visible line item on any construction budget, labour typically accounts for a larger portion of total project costs — especially in reinstatement work. This is because reinstatement isn’t just about rebuilding; it’s about doing so quickly, compliantly, and under often complex conditions.

Unlike new builds, reinstatement projects must often:

- Work within existing structures or damaged environments, which can require more specialist skill and care

- Operate on tight timelines due to business interruption pressures — meaning premium labour or overtime may be required

- Comply with updated building regulations or insurance standards, which adds complexity and labour intensity

- Coordinate multiple trades in a confined or unpredictable space, increasing the need for experienced workers and meticulous project management

In many cases, these variables make labour a more volatile and unpredictable cost driver than materials, especially when skilled personnel are in short supply.

So even as raw material prices begin to stabilise, your reinstatement cost exposure may continue to rise — or remain inflated — due to persistent labour market constraints.

How to Protect Your Business Against Underinsurance

Safeguarding against underinsurance starts with a Reinstatement Cost Assessment (RCA).

You may have had one in the recent past, but due to the severity of the UK construction industry’s labour shortage and the impact it can have on build costs, you may now be underinsured should the worst happen.

Learn how frequently RCAs should be carried out.

An RCA provides you with an up-to-date business property value that considers all foreseeable factors, from materials and labour through to business disruption.

Your assessment can then be used to correct underinsurance, ensuring you’re fully protected in the event of an emergency.

Book your Reinstatement Cost Assessment with Cardinus

We have over 27 years of experience in property services and survey 30,000 properties annually. Our nationwide network of experienced surveyors can deliver a RICS-regulated Reinstatement Cost Assessment for any property type wherever you’re located. Learn more, or contact Cardinus today to discuss your requirements.