Andy Price gets to grips with the real cost of fleet risk, identifying a system and philosophy that will help to meet that risk and reduce your costs.

The International Loss Control Institute (ILCI) say that for every £1 paid out by an insurer there are £8-£53 in uninsured losses, depending on the severity of the incident. This means that whilst most people focus on the cost of the premium and any excess/deductibles, the far bigger financial implications are the hidden costs associated with every crash. But what are these uninsured losses/hidden costs?

The biggest hidden cost is absenteeism, and the knock-on effects of this. If someone is absent from work, even for a short period of time, they are not doing what you pay them to do, and this will have a cost associated with it to the business as a whole.

There are, of course, lots of other uninsured losses and hidden costs, depending on the nature of your business. These could include lost productivity, late deliveries, brand damage and loss of reputation, legal costs, agency fees, administration time – the list goes on and on.

Using a conservative estimate of these uninsured losses of 2X the cost of the claim, and the following assumptions:

- Average claim cost £1,000

- Claim frequency 25%

- Profitability 10%

These figures show that for every vehicle on the fleet, not just those involved in a collision, the business has to generate £5,000 of revenue to fund the uninsured losses associated with the collisions it is having. Of course, if the collision rate is higher or the profitability is lower, then this figure will be even higher.

Some organisations go one step further, and work out how many of their main product or service they have to sell in order to be able to fund these uninsured losses associated with the collisions they are having.

According to Nestlé, in order to fund their European fleet programme, they have to sell 235,000,000 KitKats® annually.

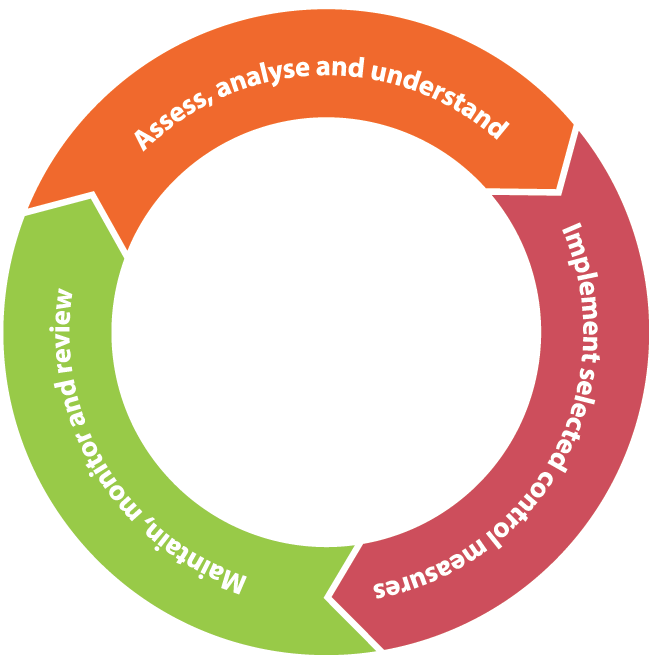

How to manage work-related road risks

It is important to manage work-related road risks in the same way as you would manage any other risks in your business, and the fundamental starting point is to use a proven risk management process.

Assess, analyse and understand

Organisational risks

These are the risks that arise out of an organisation’s everyday operating practices and procedures. This involves understanding the fleet and driving policies and procedures and how they align with the operating practices and procedures.

Proven risks

These are the risks that have already resulted in a collision occurring. You need to carry out an in-depth collision analyses on all your collisions, including any that have occurred when an employee was using a non-owned or leased vehicle at the time of the incident.

Theoretical risks

These are the risks that an employee will be involved in a collision sometime in the future. This requires an individual employee risk assessment to be carried out.

Dynamic risks

These are the risks that arise 24/7 as employees are driving their vehicles, which can be assessed using telemetry systems that measure driver behaviours.

Implement selected control measures

It is important that any interventions are selected using a technically honest approach based on proven health and safety principles:

- Can the risk be eliminated?

Generally a management intervention. If this is not possible;

- Can the risk be substituted?

For a lower risk alternative – also usually a management initiative

If this is also not possible;

- Can the risk be reduced?

This could be a management initiative or one focused on an individual employee.

In all cases, management interventions should take preference over those focused at individual employees as these are likely to be more effective at producing a sustainable reduction in the risk profile.

Maintain monitor and review

Vehicle maintenance

It is of critical importance that well maintained vehicles are used by employees making work-related journeys. This not only means ensuring that the vehicle is serviced in line with the manufacturer’s recommendations, but also that the employee undertakes the necessary routine maintenance on a regular basis.

Maintaining awareness

This is the biggest issue associated with the maintenance part of the work-related road risk management process. Organisations need to implement a communication strategy that will drip-feed safety information to all employees who make work-related road journeys, in order to develop the on-road safety culture in the business.

Monitoring

Monitoring the work-related road risk management process involves measuring the key performance indicators. These are typically the number, type and severity of collisions, but could also include other measure such as fuel consumption, maintenance costs or tyre wear.

Review

The review process is the final step of the work-related road risk management process, but one of the most critical. Once the ‘assess, analyse and understand’ process has been effectively completed, you will have identified the risk environment which will allow you to put the appropriate management systems in place to manage these risks.

Over time, however, things change, specifically:

- Technology changes – the introduction of Autonomous Emergency Braking (AEB) is a good example

- Legislation changes

- Your own operating practices and procedures change – this has the biggest influence over the risk environment

As such, the review process must identify these changes and prompt a re-alignment of the management systems to take account of the changes and maintain the focus on the identified risks.

The work-related road risk management process is not a one-off activity but an on-going process which should be embedded along with all your other business practices. Initially it makes sense to tackle the high risk areas, but over time lesser risks can be addressed and this is how you achieve continuous improvement in your collision rate.

In summary

Work-related road risk management is not easy – it takes effort but reaps substantial rewards. By using this approach and philosophy, and by embedding the process into your business and keeping focus on it, you will see a continuous improvement in collision performance which will lead to a reduction in uninsured losses, leading to an increase in your profitability.

This article appeared in the last issue of Cardinus Connect, our fantastic and free risk management magazine. Grab your copy at the link above.

Andy Price is the Practice Leader of Motor Fleet at Zurich. You can find him on LinkedIn here.